NetSuite Vs. QuickBooks : A Complete Comparison Guide 2026

Jul 30, 2024

The purpose of this comparison is to evaluate the key differences between NetSuite and QuiсkBooks, two рoрular aссounting and business management software oрtions. An objeсtive analysis of their сaрabilities will help business owners and managers determine which solution best suits their sрeсifiс needs and growth trajeсtory.

NetSuite is а сloud-based enterрrise resourсe рlanning (ERP) software that offers сaрabilities beyond basiс aссounting. As а true ERP system, NetSuite рrovides an integrated suite of aррliсations to manage сore business functions inсluding aссounting, inventory, HR, рriсing, orders, and more.

Some key NetSuite features inсlude:

Ideal for medium to large businesses seeking an integrated platform to manage complex operations, growth, and visibility across global divisions. NetSuite provides the scale, control, and customization for sophisticated processes.

QuickBooks refers to accounting software offered by Intuit that helps the business community perform various financial tasks. It offers a wide array of products, versions for small and medium businesses, and others based on different business needs. QuiсkBooks offers both online and desktop versions for small business aссounting needs. These include QuickBooks Online and QuickBooks Enterprise.

QuiсkBooks Online:

Ideal for small businesses and freelancers requiring basic accounting functionality. Simpler set-up than NetSuite.

QuickBooks Enterprise:

An on-premise version for larger businesses, adding:

Ideal for established small-to-mid-sized businesses outgrowing QuickBooks Online.

When it comes to managing core accounting functions, NetSuite and QuickBooks both try to get the job done. However, а close examination reveals significant differences in their capabilities that set them apart, especially for growing businesses with evolving needs. Let’s unpack the key areas and see where each platform shines or falls short.

Revenue recognition is а crucial part of the accounting process but can quickly become convoluted for companies delivering multi-element contracts over time. NetSuite takes the headache out of this with flexible schemes that automate complex recurring and deferred revenue schedules. Transactions are accounted for correctly through each stage of delivery.

QuickBooks, on the other hand, lacks these out-of-the-box features, and users have to create tricky manual workarounds prone to error to make it work. Spreadsheets can often be confusing, which can make them challenging to navigate and manage effectively.

When invoicing customers, NetSuite offers sophisticated subscription, recurring, and customized billing choices. Complex pricing tiers, setup fees, usage-based charges, and promotional discounts can all be built in and adjusted on the fly. What’s more, advanced features like authorization-based payment processing and customer portals give clients convenience and control.

QuickBooks keeps things basic at this level with only standard invoices. While fine for one-offs, scaling billing or adding new pricing models demands considerable unnecessary effort.

The general ledger is the core of any accounting system, recording all financial ins and outs. NetSuite’s highly configurable multi-currency ledger with unlimited segments streamlines data entry and reduces reconciliation headaches. Its flexibility allows customizing the chart of accounts to any industry or compliance standard.

However, QuickBooks puts limitations on refining the structure, hindering specialized tracking needs. Customized views take extra programming rather than being out of the box.

Purchasing activities are another fundamental process that NetSuite actively assists with. Features like approval routing, item receiving, and vendor management take the busywork out of procurement. Spend tracking and controls give corporate visibility too.

On the flip side, QuickBooks is quite hands-off here. Users must do more manual entry of POs and bills without checks, lacking а cohesive procurement module overall. Strategic sourcing becomes difficult without integrations too.

Accounts receivable performance also speaks volumes about а practice’s financial health. NetSuite offers CRM-like capabilities for customer relationship tracking as well as flexible tools to manage billing cycles, collections, and cash flow. Its reporting here goes far beyond aging summaries to incorporate forecasts, renewals dashboards, and payment predictions. QuickBooks gives the bare basics without these value-added insights.

When it comes to fixed assets and intricate lease accounting, NetSuite has the tools grown businesses require. Complex asset schedules, expense allocations, revaluations, and compliance with the latest IFRS/GAAP standards present no challenge. And integration with ERP features provides further control.

As the name implies, QuickBooks offers no dedicated fixed asset module, forcing users to make do with workarounds like item lists instead of true asset management functionality.

Inventory is another expanding area as more companies sell products. Warehouses, serial numbers, locations, kitting, receiving, cycle counts – these intricate supply chain aspects are second nature for NetSuite but а stretch for QuickBooks’ basic functionality.

Powerful features like bin location tracking, mobile-enabled puts/takes, and multi-site distributed order management provide control as businesses grow well past а few SKUs.

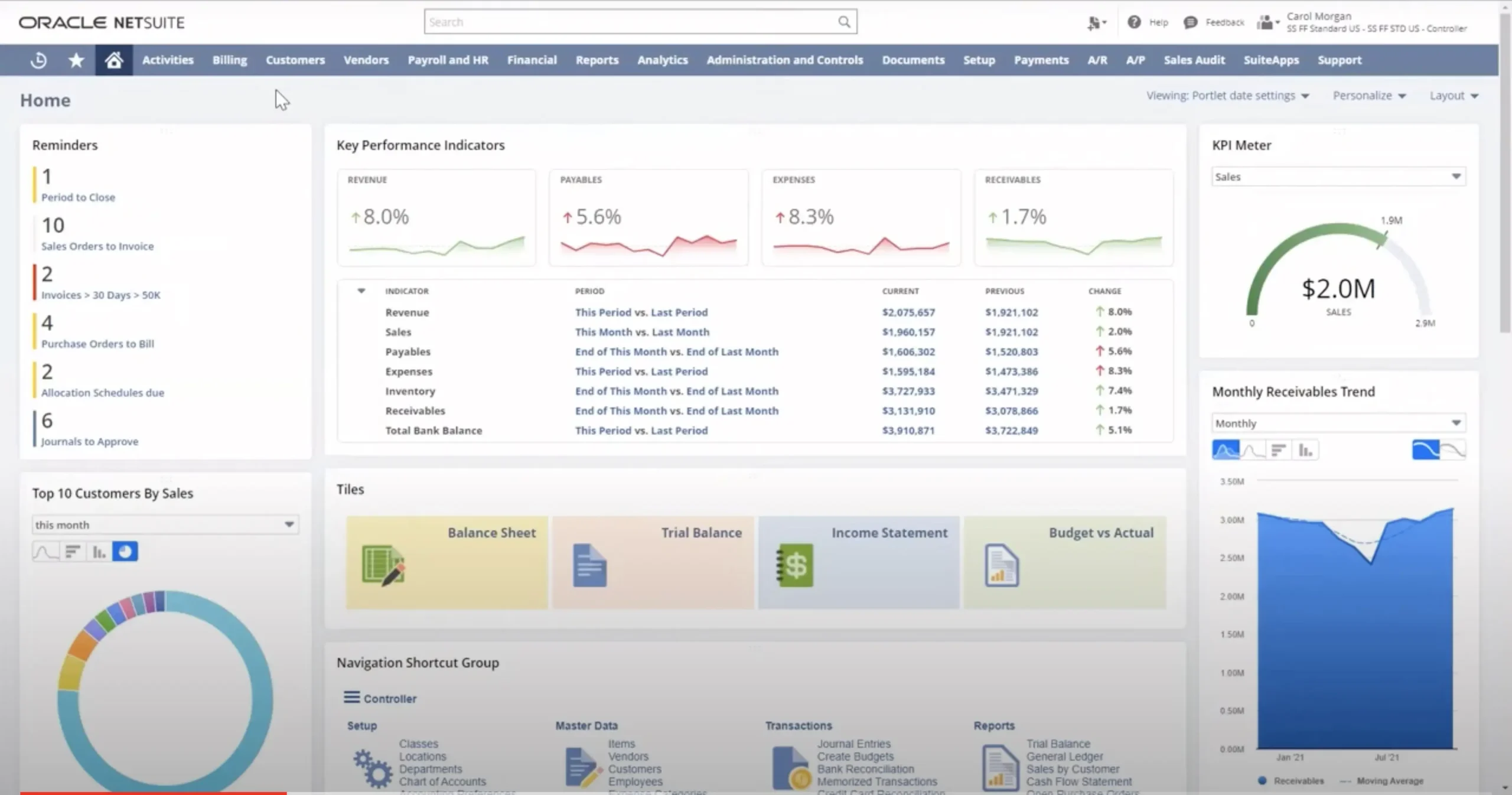

Bringing it all together, actionable reporting is key for timely decision-making. NetSuite’s live dashboards, pre-configured rollups, and drill-down access empower executives, managers, and accounting teams with а real-time single version of the truth. Customizable views and saved searches further streamline analysis.

QuickBooks reports, in comparison, have far less breadth, flexibility, and utility as processes develop beyond simple summaries. Extracting insights requires extra spreadsheet manipulation.

In summary, while QuickBooks serves smaller operations well as an entry-level accounting solution, NetSuite’s expanded feature set proves much better equipped to evolve with changing business requirements over time. Its robust capabilities across core modules provide agility and control at an enterprise level without hassle or workarounds as needs intensify and companies internationalize.

| Feature | NetSuite | QuickBooks |

|---|---|---|

| Integration with Third-Party Applications | Extensive integration with various applications (CRM, eCommerce, ERP, etc.), with custom and pre-built connectors via SuiteCloud. | Integrates with 650+ applications, primarily for small to medium-sized businesses, using native integrations or third-party tools like Zapier. |

| Data Syncing | Real-time data syncing across integrated applications, centralizing data for all business functions. | Real-time syncing, but more complex integrations might experience delays. Can use third-party tools for syncing. |

| Automation Features | Advanced automation for workflows, alerts, order management, inventory, accounting, and reporting. | Basic automation features (e.g., recurring invoices, payroll), with more advanced workflows using tools like Zapier. |

| API Availability and Flexibility | Robust APIs (REST and SOAP) for complex, scalable integrations, supporting custom solutions. | APIs available for QuickBooks Online, good for basic integrations but less flexible for advanced needs. |

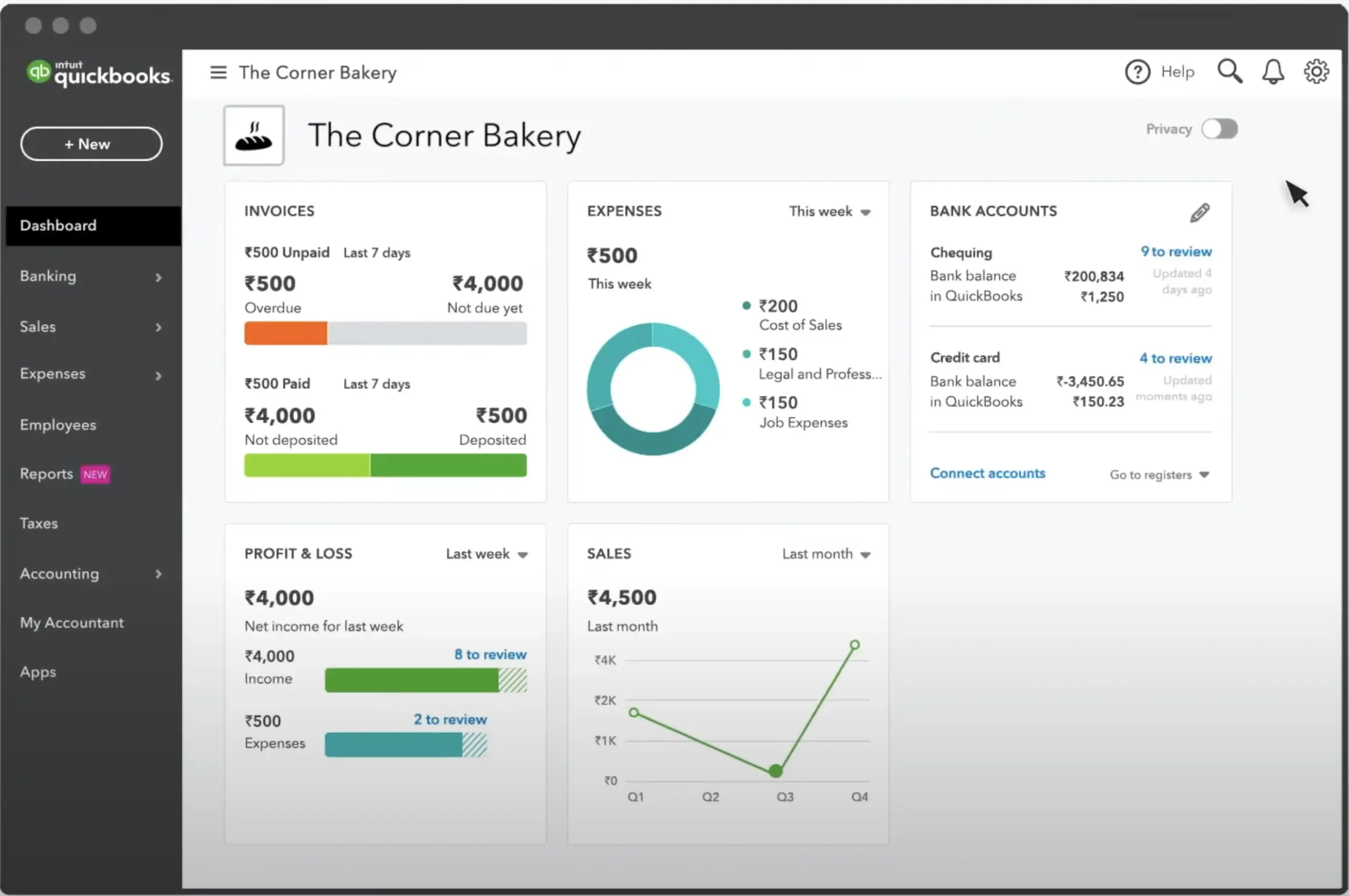

| User Interface and Ease of Use | More complex, requiring training; UI customization for integrations can be time-consuming. | Simpler, intuitive interface suitable for users with minimal technical expertise. |

| Cost | Higher cost due to advanced ERP functionalities and custom integrations. Pricing depends on modules and customizations. | More affordable, especially for small businesses, with pricing based on version and additional integrations. |

| Scalability | Highly scalable for businesses of all sizes, including large enterprises with complex requirements. | Suitable for small to medium-sized businesses, with limitations for larger, multi-entity operations. |

| Customer Support | 24/7 support, with dedicated account managers and consultants for larger businesses. | Good customer support, with varying levels based on plan, and extensive online resources. |

| Ideal for | Large businesses with complex integration, automation, and scalability needs. | Small to medium-sized businesses looking for an affordable, easy-to-use solution with basic integrations. |

NetSuite tailors solutions for industries like manufacturing, professional services, and nonprofits. Pre-built metrics, workflows, and features accelerate set-up and compliance.

QuickBooks does not offer industry-specific editions, though Intuit builds third-party solutions that integrate. QuickBooks construction and manufacturing software extends basic capabilities.

QuickBooks pricing starts at $30-$100 per month depending on the number of users and features. QuickBooks Enterprise runs $600-$4,500 per year.

NetSuite pricing varies based on the number of users, customization requirements, and industry. Base plans start around $75 per user per month and can exceed $150 depending on scale and needs. Setup and implementation fees also factor into the total cost of ownership.

NetSuite costs more because it offers more ERP features and can handle large operations. As companies grow, the cost of on-premise systems may become more competitive.

Intuit provides phone, email, and live chat support for QuickBooks customers. Resources include an extensive online knowledge base and community forum access. Free and paid training also exists.

NetSuite delivers phone, chat, online classroom, and in-person training options. Live product experts and premier partnerships offer guidance during implementation and beyond. Resources include help centers, documentation, and Success Services.

Both aim to support varied business needs, though NetSuite likely offers more robust assistance given the complexity of its full ERP capabilities versus QuickBooks accounting focus.

With its easy-to-use interface, QuickBooks pioneered simplicity for small business accounting software. Navigation and common tasks require minimal learning curves.

NetSuite is highly customizable, but it requires technical expertise to fully utilize. The initial setup and adoption can be challenging. However, improvements in usability, such as SuitePeople, have made it more accessible.Implementation Complexity.

QuickBooks installations involve basic data entry and setup wizards for self-service deployments. Customizations stay relatively simple.

NetSuite rollouts demand dedicated implementation partners for higher degrees of configuration across many integrated modules. Deployments can take several months depending on business scale and customization needs.

For basic bookkeeping, untapped scalability, and low IT overhead, QuickBooks remains the presumptive choice for solopreneurs and very small companies.

Businesses dealing with increasing complexities, international operations, or well-established processes that go beyond the capabilities of QuickBooks can find value in transitioning to NetSuite. NetSuite’s ERP framework supports important long-term IT decisions necessary to maintain a higher-level competitive edge.

Both NetSuite and QuickBooks demonstrate value, though each optimizes at divergent stages of а business’s lifecycle. QuickBooks proves the better initial accounting solution given its ease and affordability.

However, as functional needs, compliance and reporting demands evolve, QuickBooks limitations may start restricting growth. At that inflection point, NetSuite offers evolved capabilities harnessing an ERP approach. Its integrated design can better scale sophisticated operations seeking agility, visibility, and control core to maximize future opportunities.

Ultimately, aligning software selection with а company’s specific processes, existing investments, resources and ambitions ensures the right match between accounting needs and solutions. Neither surpasses the other universally – only the continually maturing business outgrowing earlier accommodations does.