Choosing the right accounting software is one of the most important financial decisions you’ll make for your business. The right platform doesn’t just help you record transactions—it streamlines processes, reduces manual errors, ensures compliance, and provides insights that shape smarter decisions.

In 2025, accounting technology has evolved beyond simple bookkeeping. Artificial intelligence, automation, and cloud-native platforms are redefining how small businesses manage their finances. Whether you’re a startup founder, a CFO at a growing business, or a CEO managing distributed teams, the right software can save you time, reduce costs, and accelerate growth.

In this guide, we’ve evaluated and ranked the top 10 accounting software for small businesses in 2025, including cloud-based solutions, free tools, and full ERP platforms like NetSuite.

Our Methodology of Evaluation for Best Accounting Software

We evaluated each platform based on pricing flexibility, scalability, integration capabilities, and customer support. But remember—the right choice depends heavily on your unique business model and growth stage. If you’re unsure how to evaluate these factors, we’ve created a detailed framework on how to choose accounting software that can guide you through the process.

- User Reviews & Satisfaction – Real-world adoption and customer sentiment across major platforms.

- Feature Comprehensiveness – Core accounting (GL, AR/AP, payroll, invoicing) plus advanced features like AI forecasting and multi-entity reporting.

- Customer Support & Usability – Ease of onboarding, learning curve, and quality of customer support.

- Pricing Flexibility – Free tiers, subscription transparency, and scalability of pricing.

- Integration Capabilities – Native integrations with payment, CRM, and ERP platforms—especially NetSuite ERP compatibility.

We weighted features and integrations higher, given the growing importance of automation and ecosystem fit.

Top 10 Accounting Software for Small Businesses in 2025

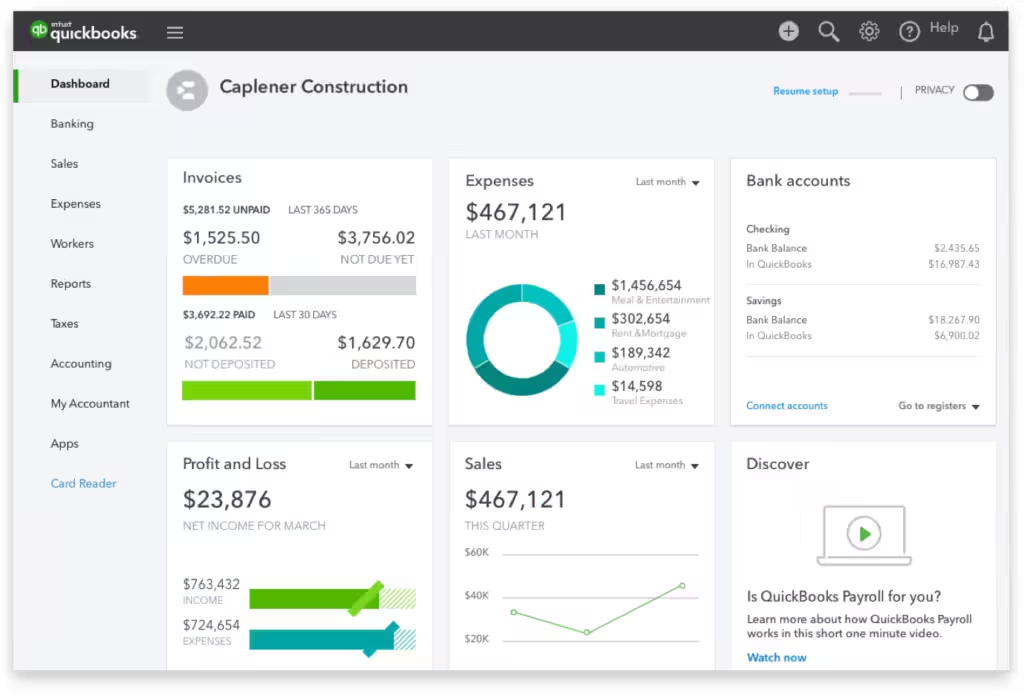

Still the most recognized name in small business accounting, QuickBooks Online has refined its offering to stay ahead of the curve.

- Pricing: Starts around $30/month, scaling up with features and users.

- Key Features: QuickBooks automates bank feeds to pull in transactions in real time, categorizing expenses with AI-driven suggestions to reduce manual errors. Its invoicing tools allow customization, automated reminders, and payment tracking, making collections smoother for SMBs. Payroll and tax modules integrate tightly, eliminating the need to juggle separate systems. Advanced reporting gives owners visibility into cash flow, profitability by product or service, and trends that support better forecasting.

- Scalability: Solid for small to mid-sized businesses, though larger organizations may hit limits with multi-entity operations.

- Integrations: Connects with hundreds of apps, including Shopify, PayPal, Salesforce, HubSpot, and payment processors. Integration supports accounting, inventory, and eCommerce workflows, allowing SMBs to maintain consistent data flow across systems.

- Pros: Familiar interface, a wide support ecosystem, and strong reporting make it a safe bet.

- Cons: Add-ons can quickly increase total costs; not ideal for companies planning rapid international expansion.

- Ideal For: SMBs needing reliable, easy-to-use accounting with a large app ecosystem.

- Cloud vs On-Prem: 100% cloud.

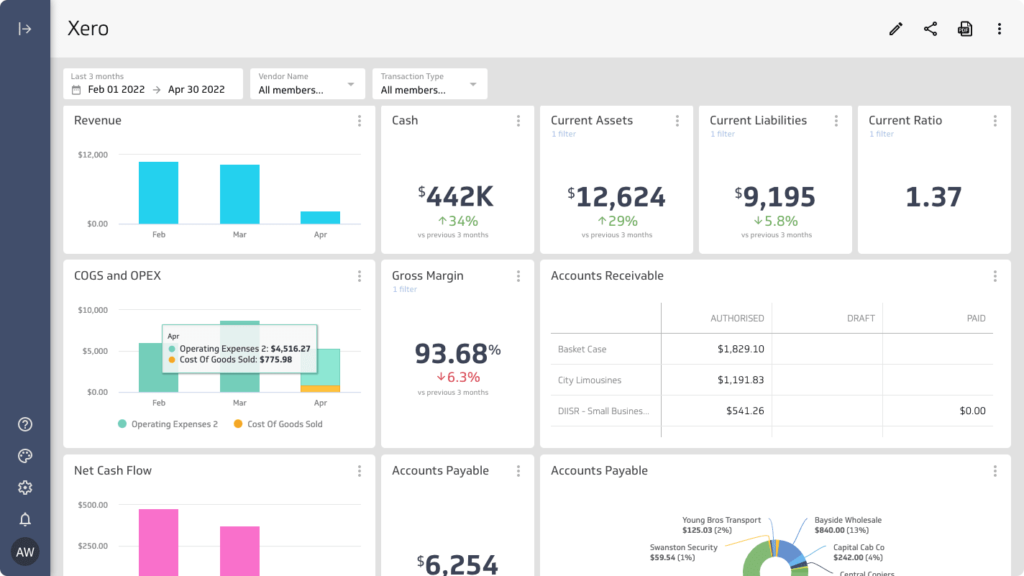

Xero remains QuickBooks’ strongest global competitor, especially in markets outside the U.S.

- Pricing: $15–$78/month, with transparent tiers.

- Key Features: Xero’s automated bank reconciliation matches transactions in seconds, cutting reconciliation time dramatically. It offers multi-currency accounting, built-in project tracking, and strong compliance features for international businesses. The platform also supports real-time collaboration between accountants and clients, meaning financial advisors can log in and resolve issues without email back-and-forth.

- Scalability: Designed to grow from small startups to mid-sized businesses, especially those expanding internationally.

- Integrations: Supports over 1,000 apps including payroll, eCommerce, CRM, and productivity tools. Native integrations streamline workflows such as invoicing, inventory, and project management, reducing duplicate data entry and errors.

- Pros: Clean interface, accountant-friendly, and globally compliant.

- Cons: Payroll support is weak in the U.S., and some advanced features require third-party add-ons.

- Ideal For: SMBs with cross-border operations or those needing easy collaboration with accountants.

- Cloud vs On-Prem: Cloud-native.

Zoho Books is one of the most cost-effective ways to professionalize financial management.

- Pricing: Free for businesses under $50K revenue; $20–$70/month for paid tiers.

- Key Features: Beyond basic bookkeeping, Zoho Books integrates with Zoho CRM and Projects, giving small businesses a full view of clients and projects. Invoicing is customizable with client portals where customers can view and pay bills. Automated workflows reduce repetitive tasks like sending reminders, applying late fees, or updating records. AI-powered insights provide anomaly detection and cash flow forecasts, which help business owners make more data-driven decisions.

- Scalability: Great for startups and small businesses looking to grow, especially if already using other Zoho apps.

- Integrations: Connects seamlessly with Zoho Suite, Stripe, PayPal, Office 365, G Suite, and other third-party apps. These integrations allow unified workflows for finance, CRM, and project management, improving efficiency across departments.

- Pros: Affordable with powerful automation and strong ecosystem value.

- Cons: Less robust for advanced inventory or revenue recognition.

- Ideal For: Startups and budget-conscious SMBs looking for AI-powered automation at a low cost.

- Cloud vs On-Prem: Cloud.

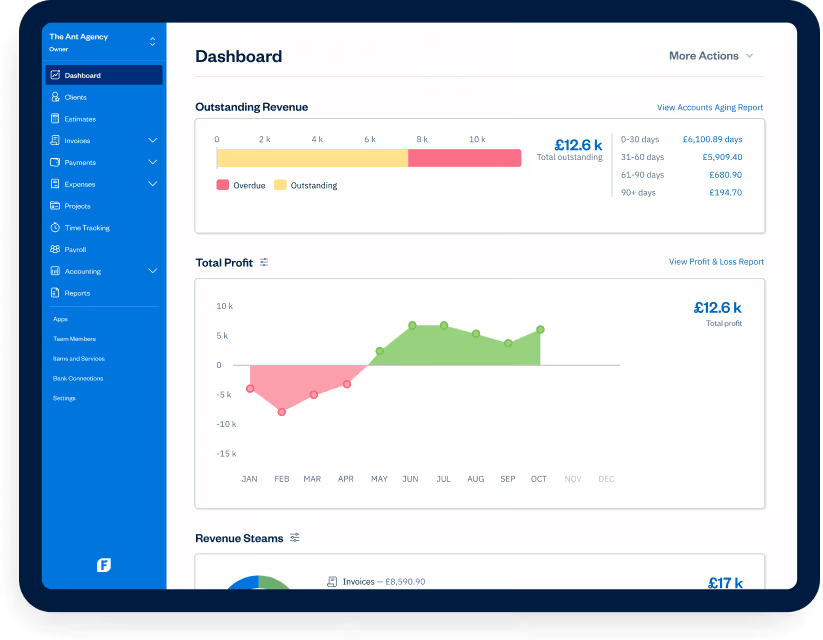

FreshBooks excels at helping service-based businesses and freelancers streamline client management.

- Pricing: $19–$60/month, with per-client pricing beyond certain limits.

- Key Features: FreshBooks combines time tracking, expense management, and project collaboration into a single platform. Its invoicing features are designed for service businesses, with the ability to bill by time, project milestones, or retainer. Expense categorization integrates with credit cards and bank accounts, and the reporting suite highlights profitability per client or project—critical for agencies or consultants managing multiple contracts.

- Scalability: Ideal for service SMBs but not designed for inventory-heavy companies.

- Integrations: Connects with Stripe, PayPal, Gusto, and over 50 productivity and project management apps. Integrations streamline invoicing, payment collection, and expense tracking, keeping service workflows cohesive.

- Pros: User-friendly interface, excellent client billing tools, and a strong mobile app.

- Cons: Weak inventory management and limited multi-entity support.

- Ideal For: Freelancers, agencies, and consulting firms.

- Cloud vs On-Prem: Cloud.

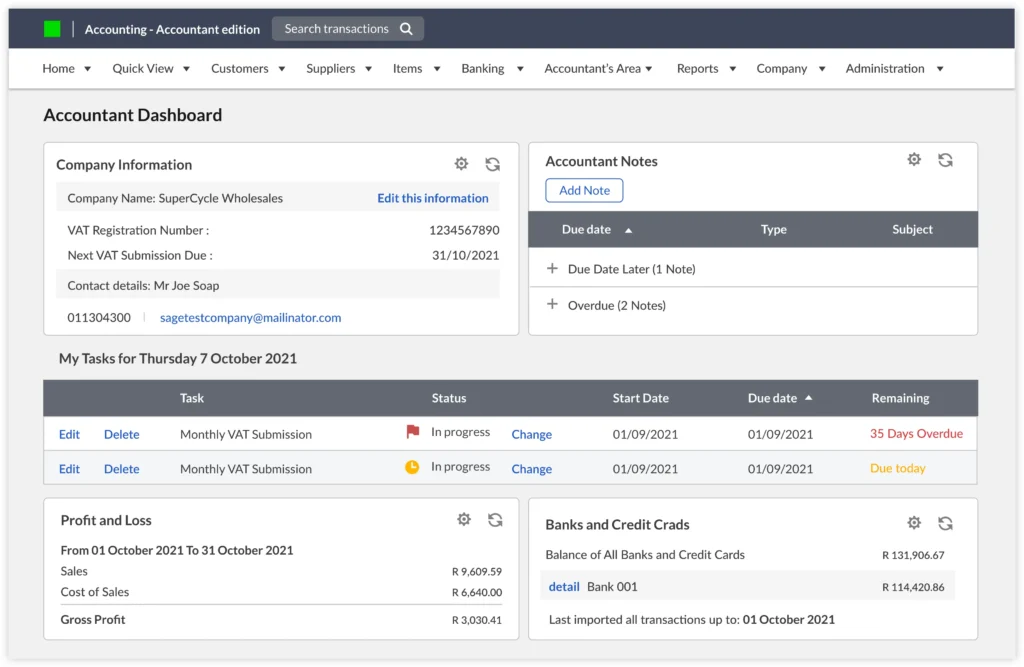

Sage combines trusted legacy accounting with modern cloud capabilities.

- Pricing: $10–$25/month for entry plans; larger Sage Intacct offerings available for mid-market.

- Key Features: Sage provides core bookkeeping, invoicing, and compliance-focused reporting, particularly strong in VAT and other region-specific tax obligations. It integrates with payroll and offers automated reconciliation, helping small finance teams save hours. Businesses that outgrow entry-level plans can upgrade seamlessly to Sage Intacct for deeper financial management, avoiding the pain of migrating to a new vendor.

- Scalability: Well-suited for SMBs that may need mid-market ERP capabilities later.

- Integrations: Integrates with payroll, CRM, and compliance tools. These connections help finance teams automate reporting and maintain accuracy across tax jurisdictions and operational modules.

- Pros: Reliable global brand, trusted by accountants, strong compliance reporting.

- Cons: Interface feels dated; automation is not as advanced as newer competitors.

- Ideal For: Businesses in compliance-heavy industries or operating across multiple tax jurisdictions.

- Cloud vs On-Prem: Cloud and hybrid options.

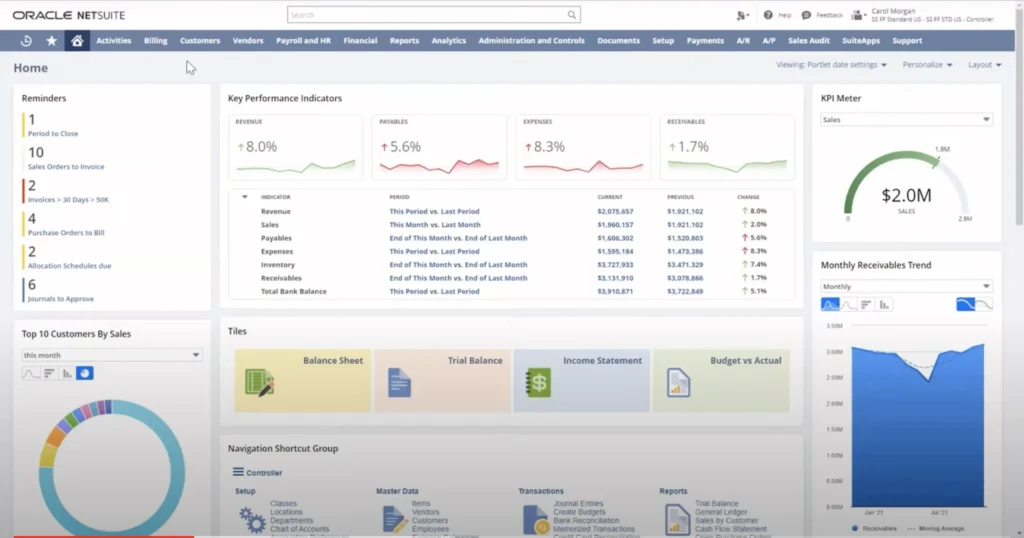

NetSuite goes beyond bookkeeping—it delivers full ERP-level financial management for businesses with growth ambitions.

- Pricing: Subscription-based; cost depends on users, modules, and implementation. NetSuite’s subscription-based pricing depends on the number of users and modules. For SMBs planning growth, it’s helpful to review NetSuite ERP pricing and subscription plans to see how costs scale with added accounting, reporting, and procurement features.

- Key Features: NetSuite consolidates accounting, financial reporting, and compliance into a single platform. It supports multi-currency, multi-entity, and advanced revenue recognition, making it ideal for global startups and SaaS firms. AI capabilities automate reconciliations, detect anomalies, and generate predictive forecasts, giving CFOs strategic insights rather than just financial records. The modular design means businesses can start with accounting and later expand into procurement, CRM, or supply chain management without switching platforms.

- Scalability: Excellent—built for SMBs that expect to grow into mid-market enterprises.

- Integrations: NetSuite offers native integrations across all its modules, complemented by NetSuite connectors for apps like Shopify, Salesforce, HubSpot, and major payment gateways.

Businesses can leverage NetSuite SuiteApps for procurement, payroll, multi-entity accounting, eCommerce, and tax compliance, keeping workflows centralized.

API-based third-party integrations allow connection to custom tools, reporting platforms, or project management systems. Automated workflows ensure real-time updates, trigger accounting entries and procurement tasks, and maintain unified operations.

- Pros: Future-proof, highly scalable, compliance-ready, strong automation.

- Cons: Higher cost and requires professional implementation support.

- Ideal For: High-growth SMBs, SaaS companies, and multi-entity businesses.

- Cloud vs On-Prem: 100% cloud.

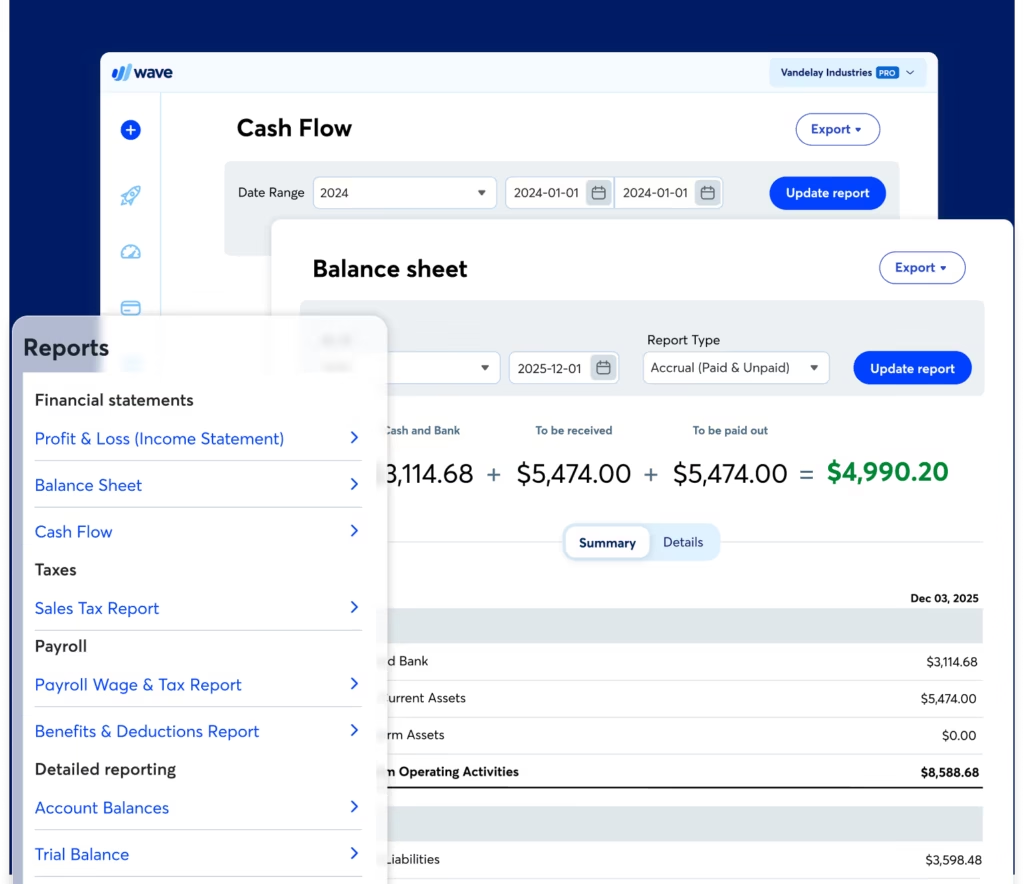

Wave remains one of the strongest free options for solo entrepreneurs.

- Pricing: Free for core accounting; payroll and payments are paid add-ons.

- Key Features: Wave offers basic invoicing, expense tracking, and receipt scanning. While it doesn’t compete with paid platforms on reporting or automation, it gives microbusinesses a professional way to manage cash flow and client payments. Its integrations with payment processors allow direct invoicing and collection, which is a step up from spreadsheets.

- Scalability: Best for freelancers and solopreneurs; outgrown quickly by growing SMBs.

- Integrations: Focused mainly on payment processors. Helps manage invoicing and collections efficiently, though reporting and automation are limited.

- Pros: Free, easy to use, no setup barrier.

- Cons: Limited automation, weak reporting, no ERP upgrade path.

- Ideal For: Freelancers or one-person businesses.

- Cloud vs On-Prem: Cloud.

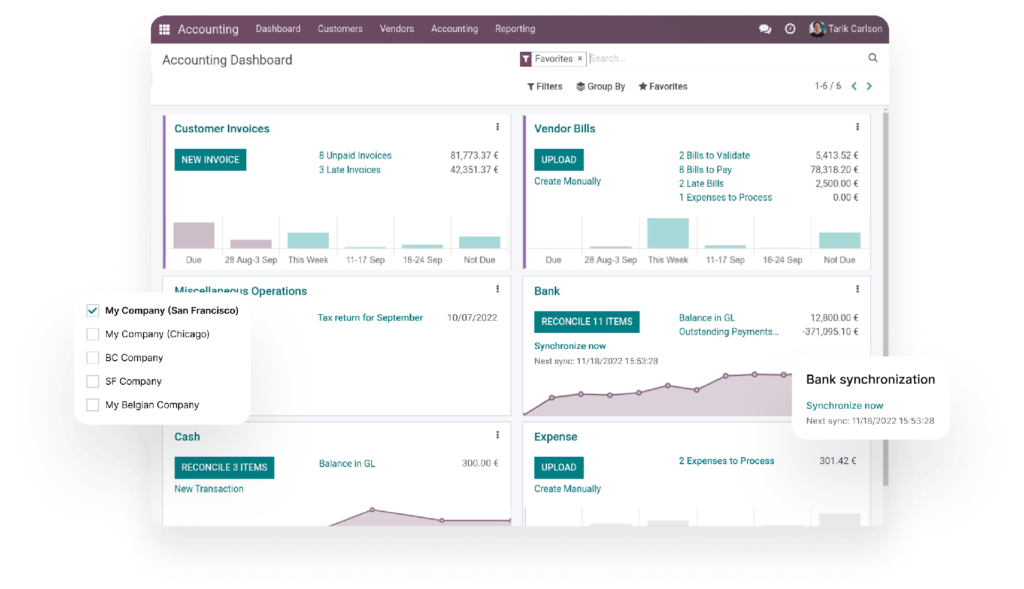

Odoo offers accounting within its broader open-source ERP ecosystem.

- Pricing: $25/month per user, with additional costs for apps.

- Key Features: Odoo’s modular approach means you can add inventory, CRM, or HR apps as your needs grow. Its accounting app covers invoicing, bank reconciliation, tax handling, and expense tracking. For tech-savvy businesses, Odoo’s customization potential is huge—dashboards and workflows can be tailored to industry needs. This flexibility is unmatched by most competitors at this price point.

- Scalability: High—suitable for SMBs ready to invest in modular ERP.

- Integrations: Best within Odoo ecosystem; APIs allow third-party integrations for inventory, CRM, HR, and eCommerce. This creates a connected ERP-lite environment where SMBs can automate workflows across modules.

- Pros: Customizable, affordable ERP-lite option, modular growth.

- Cons: Requires technical expertise for setup and maintenance.

- Ideal For: Tech-savvy SMBs with unique workflows.

- Cloud vs On-Prem: Both options available.

Microsoft’s Business Central delivers ERP-grade accounting to SMBs.

- Pricing: $70–$100/month per user.

- Key Features: Business Central combines general ledger, inventory, project accounting, and sales order management. AI features include predictive cash flow and Copilot-powered automation, which reduce manual data entry and highlight financial risks before they occur. Businesses invested in Microsoft tools gain a major advantage, as it integrates tightly with Outlook, Teams, and Power BI for unified reporting and collaboration.

- Scalability: Very strong—capable of handling multi-entity, global SMBs.

- Integrations: Deep integration with Microsoft ecosystem—Outlook, Teams, Power BI—plus connectors for third-party apps. Integrations allow seamless reporting, collaboration, and workflow automation across departments.

- Pros: Powerful reporting, native AI tools, seamless with Microsoft ecosystem.

- Cons: Higher learning curve, requires careful setup.

- Ideal For: SMBs already using Microsoft software and planning to scale.

- Cloud vs On-Prem: Cloud-first, with hybrid support.

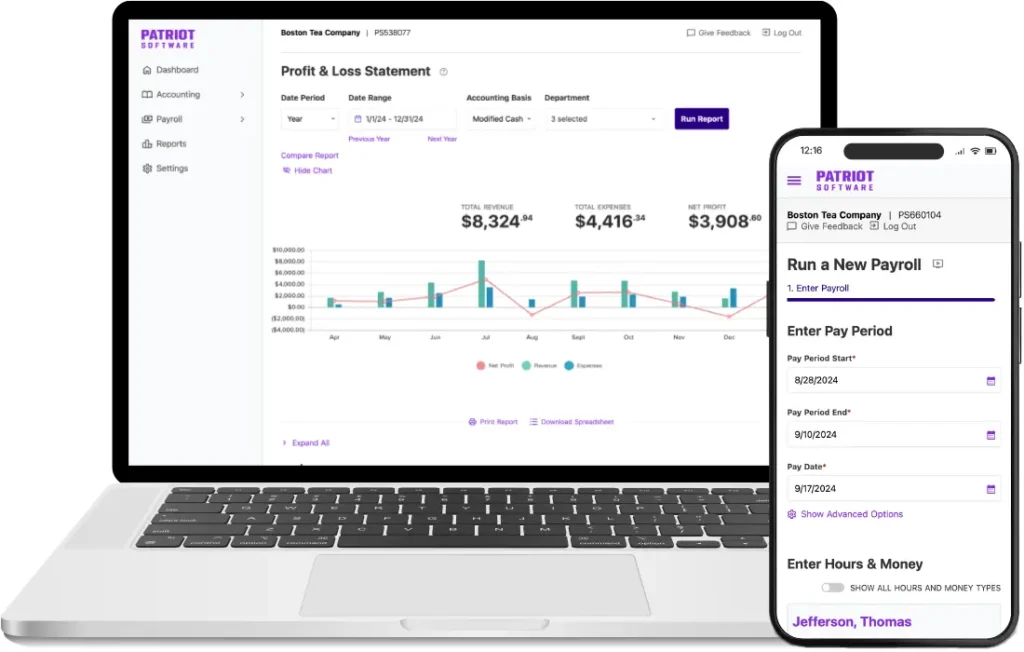

Patriot is a budget-friendly choice for small U.S.-based businesses.

- Pricing: $20–$30/month; payroll add-ons available.

- Key Features: Patriot provides easy invoicing, expense tracking, and payroll in one package. While not feature-heavy, it covers compliance basics such as tax form filing and reporting. The simple interface is designed for non-accountants, allowing business owners to manage books without steep learning curves.

- Scalability: Limited; designed for micro to small businesses.

- Integrations: Minimal, focused on U.S. payroll and tax.

- Pros: Affordable, compliance-friendly, easy to use.

- Cons: Limited reporting and no global features.

- Ideal For: Small U.S. businesses prioritizing affordability.

- Cloud vs On-Prem: Cloud.

Accounting Software Comparison for SMBs in 2025

This table comparison highlights pricing, integrations, scalability, and unique strengths of the top 10 accounting solutions, helping SMBs make an informed choice for their financial management in 2025.

| Software | Best For | Key Differentiator | Integration & Scaling | Pricing (USD) |

|---|

| QuickBooks Online | SMBs needing familiar, reliable accounting | AI-driven transaction categorization, strong reporting | Integrates with hundreds of apps; good for small to mid-sized businesses; limited multi-entity support | $30+/mo |

| Xero | SMBs with cross-border operations | Multi-currency, accountant-friendly | Over 1,000 app connections; scales internationally | $15–$78/mo |

| Zoho Books | Cost-conscious startups | Affordable, automation-ready | Integrates with Zoho Suite and key third-party apps; scalable within Zoho ecosystem | Free–$70/mo |

| FreshBooks | Service-based SMBs, freelancers | Time/project-based billing, client portals | Integrates with Stripe, PayPal, Gusto; limited beyond service-focused businesses | $19–$60/mo |

| Sage Business Cloud | Compliance-heavy SMBs | Reliable tax/VAT reporting, upgrade path to Intacct | Integrates with Microsoft 365; suitable for businesses with complex compliance needs | $10–$25/mo (entry); Intacct pricing varies |

| NetSuite ERP | High-growth SMBs, multi-entity, SaaS | Enterprise-grade accounting, AI automation, modular ERP | Native module integrations, SuiteApps, connectors for Shopify/Salesforce, API support; enterprise-ready, scalable globally | Custom subscription (starting ~$1,000/mo) |

| Wave | Freelancers & solopreneurs | Free core features, simple invoicing | Limited integrations; not scalable for growing businesses | Free (with paid add-ons) |

| Odoo Accounting | Tech-savvy SMBs | Modular ERP approach, customizable workflows | Integrates with Odoo apps; scalable with modules | $24–$37/user/mo |

| Microsoft Dynamics 365 BC | SMBs in Microsoft ecosystem | AI forecasting, Power BI, deep Microsoft integration | Integrates with Microsoft 365; suitable for businesses seeking advanced analytics | $70–$110/user/mo |

| Patriot Accounting | U.S. micro/small businesses | Affordable, simple, payroll-friendly | Limited reporting, no global support | $20–$30/mo |

Market Trends in Accounting Software 2025

The accounting software landscape has evolved far beyond spreadsheets and simple bookkeeping tools. In 2025, several key trends are shaping how small businesses approach financial management:

1. AI-Powered Automation Becomes Standard

Accounting platforms are no longer just recording numbers—they’re interpreting them. From automatic transaction categorization to predictive cash flow analytics, AI is embedded into everyday workflows. Tools like QuickBooks and Xero already offer automated reconciliation, while NetSuite and Microsoft Dynamics 365 are pushing further with AI-driven forecasting and anomaly detection to flag unusual spending or compliance risks.

2. Cloud-First Adoption

On-premise accounting solutions are rapidly declining in favor of cloud platforms. Small businesses value the flexibility of accessing financial data anywhere, along with the lower upfront costs of SaaS pricing. In 2025, over 80% of SMBs use cloud accounting systems, making it the default standard rather than a premium choice.

3. Embedded Integrations with ERP and Ecosystems

Accounting software is no longer a siloed tool—it’s part of the larger business stack. For SMBs, integrations with CRM, payroll, eCommerce, and inventory are becoming must-haves. Platforms like NetSuite and Odoo extend naturally into full ERP, while Xero and QuickBooks rely on strong app marketplaces to connect with Shopify, HubSpot, or Stripe.

4. Globalization and Multi-Entity Needs

Even small startups are increasingly global from day one—selling internationally, hiring remotely, and managing multiple currencies. This is driving demand for tools with built-in localization, tax compliance, and consolidation features. Xero, NetSuite, and Dynamics 365 are particularly strong in this area.

5. Cost Efficiency and ROI Focus

Economic uncertainty in 2025 is pushing small businesses to scrutinize costs more closely. Free or low-cost solutions like Wave and Patriot are popular for micro-businesses, while fast-growing SMBs are willing to invest in more advanced systems if they see clear ROI through automation, reduced errors, and faster closes.

Conclusion

Choosing the right accounting software is about more than tracking transactions—it’s about enabling growth, reducing manual effort, and ensuring seamless operations. For early-stage SMBs or solopreneurs, platforms like Wave and Zoho Books offer affordable automation and core financial management. Service-oriented businesses benefit from FreshBooks’ client-focused billing and project tracking, while globally expanding SMBs may find Xero or Microsoft Dynamics 365 Business Central ideal for multi-currency support and international compliance.

For high-growth companies planning to scale into mid-market or manage multiple entities, NetSuite ERP stands out with its modular architecture, AI-driven insights, and extensive integration ecosystem, unifying accounting, procurement, and reporting workflows. Aligning software choice with business size, complexity, and integration needs ensures better financial visibility, operational efficiency, and long-term scalability—turning your accounting system into a strategic growth tool rather than just a record-keeping solution.