Reconciliation is no longer a back-office chore—it’s a critical element of enterprise financial integrity. As the pace of business accelerates and financial ecosystems become increasingly fragmented, the traditional, manual reconciliation process simply can’t keep up. Errors, delays, and fragmented audit trails are no longer just operational nuisances; they’re liabilities. In 2026, forward-thinking enterprises are moving beyond spreadsheets and static checklists, embracing intelligent automation to keep pace with complex reconciliation demands.

NetSuite Account Reconciliation, now backed by Oracle’s robust Cloud EPM infrastructure, offers a dynamic, integrated solution to turn a cumbersome process into a strategic lever. Whether you’re managing high-volume bank transactions, reconciling intercompany accounts, or aligning settlement data from payment processors, NetSuite’s dedicated reconciliation tool introduces control, visibility, and speed.

What Is NetSuite Account Reconciliation?

At its core, reconciliation ensures alignment between what a business thinks it owns—or owes—and what’s externally confirmed. It involves comparing internal records such as general ledger balances with external data sources like bank statements, vendor payment confirmations, intercompany transfers, and merchant settlements.

NetSuite Account Reconciliation goes far beyond basic matching. It provides a centralized, secure, and rules-based environment for reconciling all balance sheet accounts—from bank and credit card accounts to intercompany receivables and accruals. It automatically matches transactions using configurable logic, flags exceptions in real-time, and supports collaborative resolution through built-in workflows.

Importantly, NetSuite Account Reconciliation isn’t bundled in the core ERP suite—it’s an integrated solution powered by Oracle’s Cloud EPM platform. This architecture enables real-time integration, scalability, and cloud-grade performance, making it suitable for mid-sized businesses and global enterprises alike.

For organizations looking to adopt this advanced functionality or optimize their close process, partnering with a provider of NetSuite accounting services can ensure seamless implementation, configuration, and integration. Expert support helps finance teams get the most out of the platform—whether it’s customizing reconciliation rules, setting up live bank feeds, or aligning the process with broader financial reporting strategies

Why Reconciliation Automation Is Essential in 2026

The demands on finance teams have shifted. It’s no longer enough to close the books—it must be fast, accurate, and audit-ready. Manual reconciliation methods, with their spreadsheets, siloed systems, and versioning errors, expose organizations to delays, control failures, and financial misstatements.

Today’s challenges include:

High transaction volumes from omnichannel sales, digital payments, and multi-currency operations.

Complex entity structures involving intercompany eliminations, shared service centers, and decentralized finance teams.

Ever-tightening compliance requirements, including SOX, IFRS, and internal control audits.

Automation doesn’t just improve efficiency—it enhances control. NetSuite’s reconciliation module:

Reduces close cycles by days or even weeks.

Detects anomalies early through exception alerts and rule-based checks.

Maintains full audit trails for every match, comment, and sign-off.

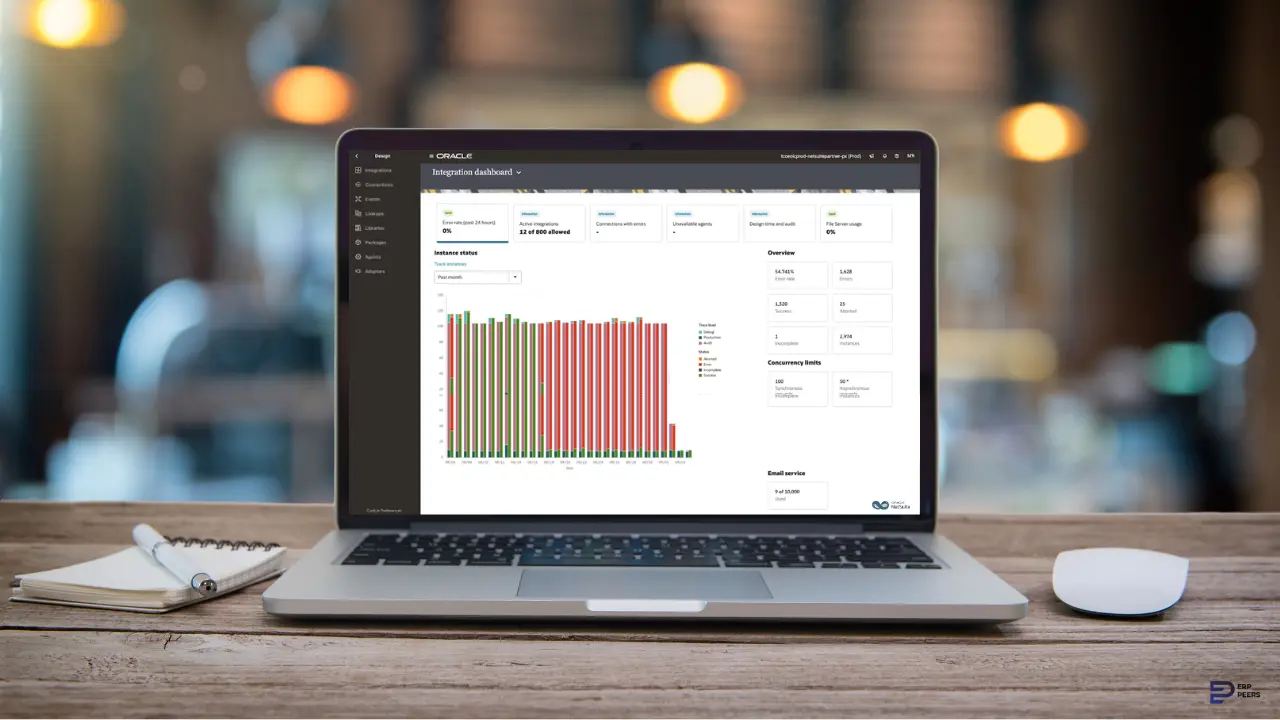

What once required dozens of spreadsheets, nightly batch jobs, and disconnected approvals is now handled through a live, interactive dashboard.

Deep Dive: NetSuite’s Reconciliation Features

1. Automated Matching Engine

Transactions are matched using logic configured by your team—based on date, amount, reference IDs, or custom fields. Whether it’s one-to-one or many-to-many matching, the engine processes thousands of records per minute with high accuracy. This reduces manual effort and elevates the accounting team’s focus to exceptions, not routines.

2. Integration with GL, Bank Feeds & External Systems

NetSuite Bank integration services eliminates the need for manual exports. Real-time bank feeds, POS platforms, and merchant gateways connect via SuiteApp connectors. As of 2026, over 14,000 financial institutions are supported for live feeds. This not only accelerates matching but improves the reliability of data with fewer reconciliation delays.

3. Exception Reporting & Dashboards

Interactive dashboards surface unmatched transactions, aged items, or suspicious entries. Exception handling becomes a collaborative process—with the ability to comment, reclassify, or escalate entries directly within the platform. The system flags anomalies instantly, allowing teams to intervene before errors spiral.

4. Audit-Ready Document Management

Each reconciliation can include attachments—such as bank statements, internal memos, or compliance policies—securely stored in NetSuite’s document repository. Approval workflows are time-stamped, role-based, and fully trackable. This transparency strengthens your audit position and supports SOX compliance with ease.

5. Prebuilt Templates & Variance (Flux) Analysis

More than 20 reconciliation templates accelerate implementation for common account types. Built-in flux analysis flags variances across periods, helping controllers and auditors understand material fluctuations before questions arise.

How It Works – The Process in Action

Activate Reconciliation Module: Enable the add-on via your NetSuite + Oracle EPM account.

Connect Bank Feeds: Use SuiteApp or CSV uploads depending on your financial institutions.

Define Matching Rules: Start simple (amount, date), then evolve with complexity (custom logic).

Match Automatically: The system processes and reconciles records in bulk.

Triage Exceptions: Exceptions are routed to designated reviewers with commentary and escalation paths.

Attach Documents: Store and retrieve support documents within each reconciliation.

Sign Off & Archive: Approvals are logged, locked, and auditable for internal and external stakeholders.

Practical Use Cases by Industry

Financial Services: Daily reconciliations across accounts, regulatory compliance, high audit frequency.

Retail & eCommerce: Payment gateway settlement reconciliation, refunds tracking, bank deposit alignment.

Manufacturing: Multi-entity reconciliations across intercompany payables, receivables, and inventory holding accounts.

Each use case shares a common thread: the need for visibility, control, and speed—all delivered through NetSuite’s architecture.

Implementation Best Practices

Start with High-Volume Accounts: Prioritize bank and credit card accounts first.

Iterate Matching Logic: Begin with basic parameters; evolve based on reconciliation history.

Automate Import Frequency: Live feeds offer unmatched reliability—use SuiteApp where supported.

Assign Triagers, Not Reviewers for Everything: Avoid bottlenecks; route only exceptions to senior reviewers.

Train Teams Continuously: Features evolve; change management is essential to full utilization.

Compliance & Internal Controls

NetSuite Account Reconciliation supports a secure, policy-driven control environment:

Time-stamped audit trails of all activity.

Role-based access to prevent unauthorized changes.

Documented approval chains for SOX or external audit compliance.

Centralized digital archives, eliminating fragmented file storage.

With increasing regulatory scrutiny, businesses need more than just accurate numbers—they need traceability, governance, and readiness.

ROI and Cost Drivers

The cost of NetSuite Account Reconciliation varies based on user count, entity structure, and transaction complexity. Mid-market companies often spend a few thousand dollars annually for the module. Large enterprises investing in automation across regions may see higher upfront costs but realize quicker payback.

Key ROI drivers include:

Shortened close cycles.

Fewer manual hours.

Lower risk of audit penalties.

Improved control environment.

By reducing labor-intensive reconciliation efforts, finance teams can redirect focus to analysis, forecasting, and value-generating work.

What’s New in 2026?

The 2026 updates bring notable enhancements:

Expanded Bank Feed Coverage: Over 14,000 institutions now supported in North America.

Generative AI for Variance Reporting: Drafts narrative insights around flux patterns.

Enhanced UI for Approval Workflows: Streamlined multi-level sign-offs with conditional triggers.

Bill Capture Sync: Duplicate detection and side-by-side invoice views enhance AP reconciliation.

Together, these updates solidify NetSuite’s position as a best-in-class reconciliation platform—ready for the speed and complexity of modern finance.

Conclusion

Reconciliation is no longer about closing the books. It’s about maintaining financial truth, instilling confidence, and enabling better decisions. NetSuite Account Reconciliation brings structure to chaos, speed to delay, and visibility to ambiguity. For companies that value accuracy, agility, and governance, 2026 presents the perfect time to modernize reconciliation for the future. As businesses prepare for the challenges and expectations of 2026, modernizing reconciliation is no longer optional—it’s essential. Backed by dedicated NetSuite support services, organizations can ensure that every step—from implementation to exception handling—is optimized for speed, accuracy, and resilience.