NetSuite OneWorld: Global Business Management System Guide

Jun 05, 2025

Managing a business in different places isn’t just about selling in new markets. It also means dealing with separate accounting systems, handling money in different currencies, following tax rules in different regions, and creating reports that bring everything together on time. Whether you have several subsidiaries, are growing internationally, or have teams working in different locations, running things smoothly can get complicated fast.

NetSuite OneWorld is designed to centralize that complexity within a single, unified ERP environment giving you visibility, control, and compliance across entities without sacrificing local autonomy.

This guide breaks down what NetSuite OneWorld is, who it’s for, how it works, and why it matters. We’ll cover its features, comparisons with other ERP systems, and answer key queries you might have about NetSuite OneWorld.

NetSuite OneWorld is a cloud ERP solution designed for businesses operating across multiple subsidiaries, legal entities, countries, and currencies. It extends standard NetSuite ERP modules by adding global consolidation, multi-currency support, localized tax compliance, and intercompany automation.

In simpler terms, If your company has multiple entities in different countries (or even states), OneWorld helps you manage them all under one unified system while still keeping them legally separate.

NetSuite OneWorld is built for organizations that operate across geographic, financial, and legal boundaries. This includes:

If your team spends too much time on manual consolidations, tax compliance, or intercompany adjustments, OneWorld addresses those bottlenecks natively.

| Situation | Why OneWorld Helps |

|---|---|

| Adding a new international subsidiary | Handles new currency, tax, and reporting needs out of the box |

| Complex intercompany transactions | Automates eliminations and balances transactions across entities |

| Need for real-time global visibility | Consolidated dashboards and reports without manual reconciliation |

| Facing multi-country tax compliance | Built-in tax engines support local tax rules and reporting |

Manage multiple entities with different base currencies, fiscal calendars, and local reporting requirements, all within a single NetSuite account. This lets you keep local control while having a clear, centralized overview.

Automatically combine financial data from all entities, eliminating duplicate intercompany transactions. See consolidated balance sheets, profit & loss, and cash flow reports instantly, not just after month-end.

Supports over 190 currencies with automatic updates of exchange rates. All transactions are recorded in local and base currencies, making global reporting and compliance hassle-free.

Out-of-the-box support for VAT, GST, sales tax, and more across 100+ countries. NetSuite’s SuiteTax engine updates tax rules automatically, reducing manual tax setup and errors.

Simplify transactions between subsidiaries by automatically creating matching invoices, payments, and journal entries. Supports complex multi-step intercompany processes with minimal manual work.

See your inventory across all locations in real time. The system helps route orders to the best warehouse or supplier based on stock levels, delivery times, or regional demand.

Maintain parallel accounting books for different standards (like IFRS and GAAP) at the same time. This means you can meet different country requirements without redoing work.

Generate financial reports, tax filings, and audit documentation tailored to each country’s rules, including specific charts of accounts and report templates.

| Feature | Standard NetSuite | NetSuite OneWorld |

|---|---|---|

| Supports multiple subsidiaries | ❌ No | ✅ Yes |

| Consolidates financials globally | ❌ Limited | ✅ Full consolidation with currency/tax support |

| Handles multi-currency operations | ❌ Basic | ✅ Advanced with real-time FX updates |

| Local tax compliance support | ❌ Minimal | ✅ Country-specific support built-in |

| Intercompany transaction automation | ❌ Manual | ✅ Automated |

| Capability | NetSuite OneWorld | SAP Business One | Microsoft Dynamics 365 | Oracle EBS |

|---|---|---|---|---|

| Deployment | Cloud-native | Hybrid | Cloud/On-prem | Primarily On-prem |

| Multi-subsidiary support | Native, built-in | Limited add-ons | Available, less integrated | Strong, but complex |

| Financial consolidation | Real-time, automatic | Requires manual effort | Scheduled batch jobs | Custom setups needed |

| Tax compliance | Built-in global tax engine | Regional tax support | External plug-ins required | Strong, but requires configuration |

| Intercompany automation | Fully automated | Manual or via integration | Some automation | Strong with customization |

| Time-to-implement | Fast (3–6 months) | Moderate (6–12 months) | Moderate | Long (12+ months) |

| Licensing model | Subscription-based | Perpetual + annual | Per user/module | Perpetual + support |

NetSuite OneWorld pricing varies widely based on several factors, so there’s no fixed public price. To understand the full pricing picture – including licensing, user fees, modules, and implementation costs check out our comprehensive NetSuite pricing guide.

Here are the key factors that influence the cost:

| Pricing Factor | Description |

|---|---|

| Base License Fee | Starts with a foundational ERP license, then adds OneWorld capabilities. |

| Number of Subsidiaries | More subsidiaries increase licensing complexity and cost. |

| User Licenses | Pricing scales based on user roles—view-only, full access, admin, and more. |

| Additional Modules | Add-ons like Advanced Financials, Multi-Book Accounting, or SuiteTax increase fees. |

| Implementation Partner | Partner expertise and project scope significantly impact service expenses. |

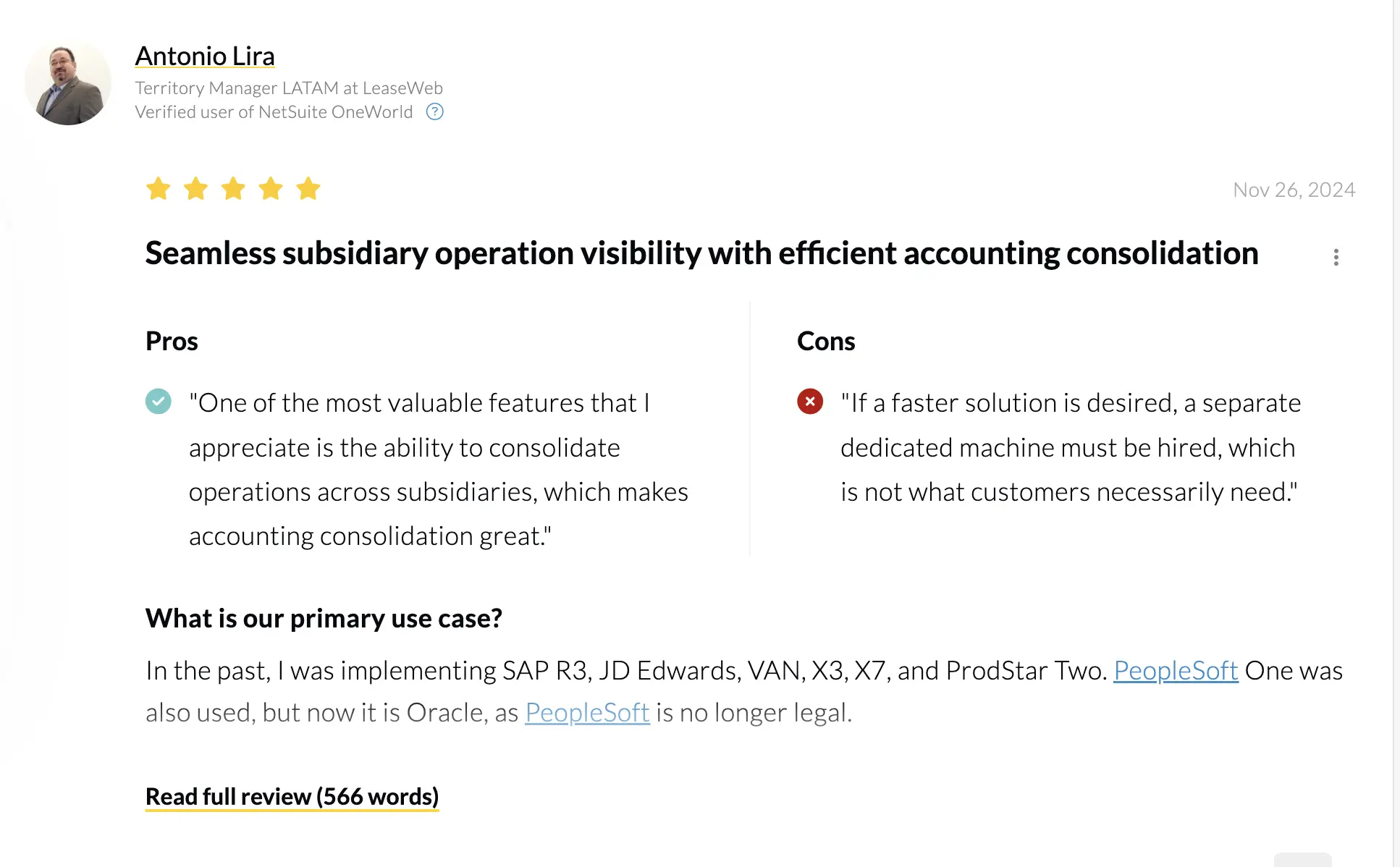

To give you a clearer picture beyond feature lists, here are excerpts from actual user reviews of NetSuite OneWorld shared on platform like PeerSpot.

NetSuite OneWorld is built for growing, global businesses that need control, visibility, and compliance across multiple entities. If you’re managing expansion, acquisitions, or international operations, it’s one of the most comprehensive ERP options available in the cloud today.