Top 11 QuickBooks Alternatives for Growing Businesses

Oct 28, 2025

QuickBooks is often the first accounting tool small businesses rely on—and for good reason. It’s simple, affordable, and built for early-stage companies that need basic bookkeeping and financial management.

But as your business grows, your needs evolve. Managing multiple entities, integrating inventory, syncing data from eCommerce channels, or getting real-time profitability reports can quickly push QuickBooks beyond its limits. If you find yourself using endless spreadsheets or manual workarounds, it’s time to explore more scalable ERP solutions.

This guide explores the best QuickBooks alternatives available today—each with its own strengths, features, and ideal use cases. Whether you’re scaling operations, managing complex financials, or expanding internationally, here are systems worth considering.

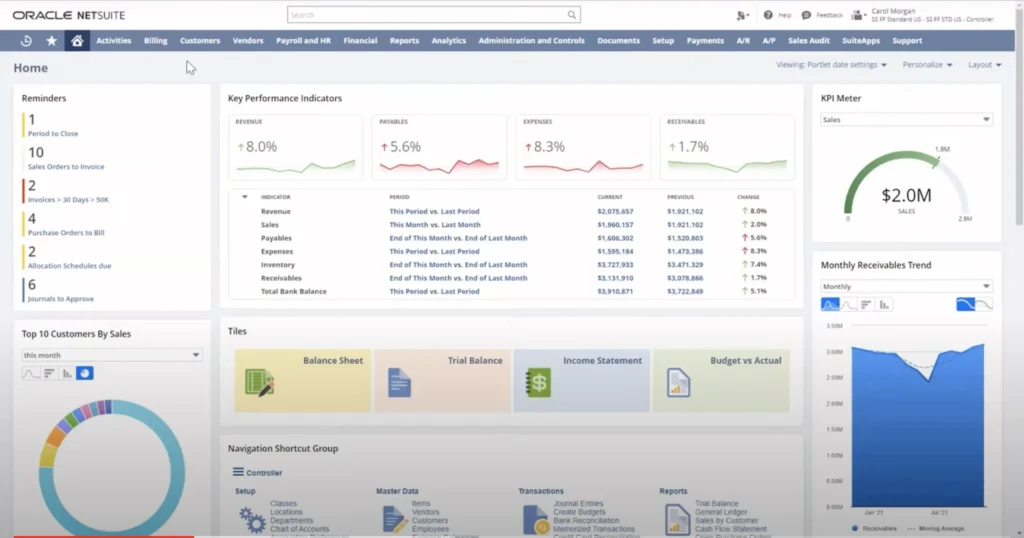

NetSuite is one of the most comprehensive cloud-based ERP platforms designed for fast-growing and mid-market businesses. It covers everything from accounting and order management to inventory, CRM, procurement, and manufacturing. Businesses moving from QuickBooks often find NetSuite appealing because it eliminates manual work and provides a unified view of operations across all departments. It’s particularly powerful for multi-entity, multi-currency, and multi-location businesses.

If you’re currently evaluating a move from QuickBooks, you can check our detailed comparison — QuickBooks vs NetSuite to understand how these two platforms differ in scalability, reporting, and automation.

Key Features:

Pricing:

The NetSuite pricing model is subscription-based and depends on the number of users, modules, and the overall scope of your implementation. For small to mid-sized businesses, pricing typically starts around $999 per month, plus additional per-user fees. Since NetSuite is modular, the total cost varies depending on which features — such as inventory, manufacturing, or advanced financials — you include in your setup.

Why It’s a Strong Alternative:

NetSuite replaces not just QuickBooks but the collection of disconnected apps businesses often rely on. It provides a single source of truth for finance and operations—perfect for companies planning to scale sustainably.

Best for: Growing and mid-sized businesses seeking all-in-one automation

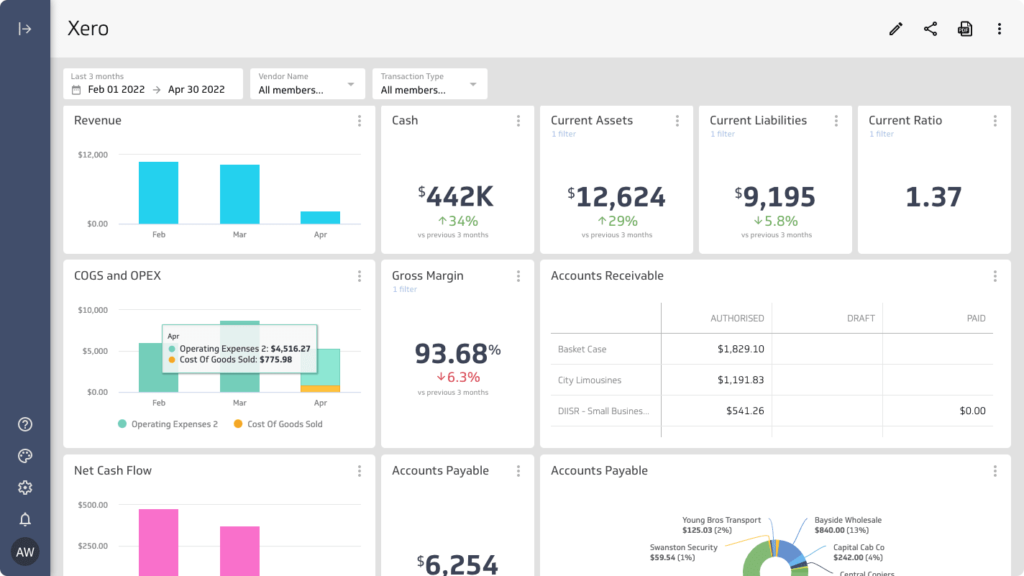

Xero offers an easy-to-use interface similar to QuickBooks but with better collaboration tools and a clean cloud-based design. It’s particularly strong for service-based or small retail businesses looking for a smooth transition from QuickBooks without high complexity. It supports real-time bank feeds, automated invoicing, and integrations with hundreds of business apps.

Key Features:

Pricing:

Starts at $15/month for the Early plan, with growing and established plans up to $78/month.

Why It’s a Strong Alternative:

Xero offers similar functionality to QuickBooks but with better collaboration tools, clearer reporting, and a smoother user experience—ideal for teams tired of QuickBooks’ cluttered workflows.

Best for: Small to mid-sized businesses wanting modern accounting simplicity

Zoho Books is a strong contender for growing SMBs that want a balance of affordability and functionality. It’s part of the Zoho ecosystem, which means it integrates well with Zoho CRM, Projects, and Inventory. Its automation capabilities — from recurring invoices to payment reminders — save time for finance teams.

Key Features:

Pricing:

Offers free version with limited features. Paid plans range from $20 to $70/month.

Why It’s a Strong Alternative:

Zoho Books is perfect for businesses looking for affordability and ecosystem integration. It’s more automation-ready than QuickBooks while staying lightweight and easy to manage.

Best for: Small businesses and service-based firms

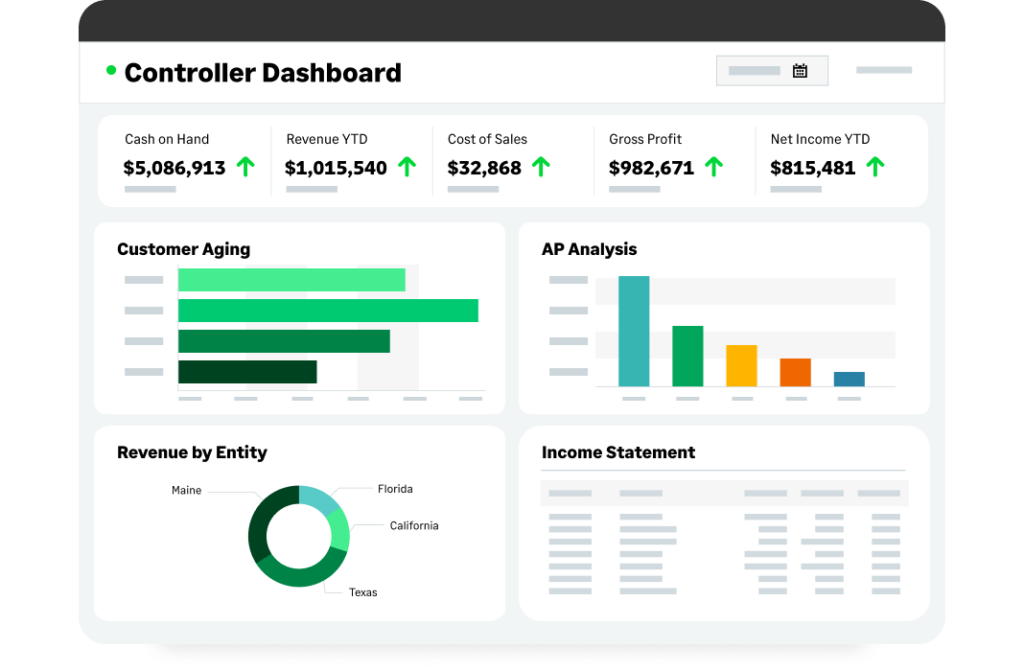

Sage Intacct is a cloud-based financial management platform tailored for businesses that need deeper accounting functionality than QuickBooks can provide. It’s especially popular in professional services, SaaS, and nonprofit sectors. Sage Intacct shines in financial consolidation, budgeting, and compliance, offering the kind of audit-ready controls larger teams need.

Key Features:

Pricing:

Starts around $400/month (varies by user and modules).

Why It’s a Strong Alternative:

Sage Intacct is ideal for businesses that have outgrown QuickBooks’ accounting depth. It adds strong financial controls, making it a great fit for SaaS, non-profit, and professional service firms.

Best for: Finance teams needing advanced accounting and compliance

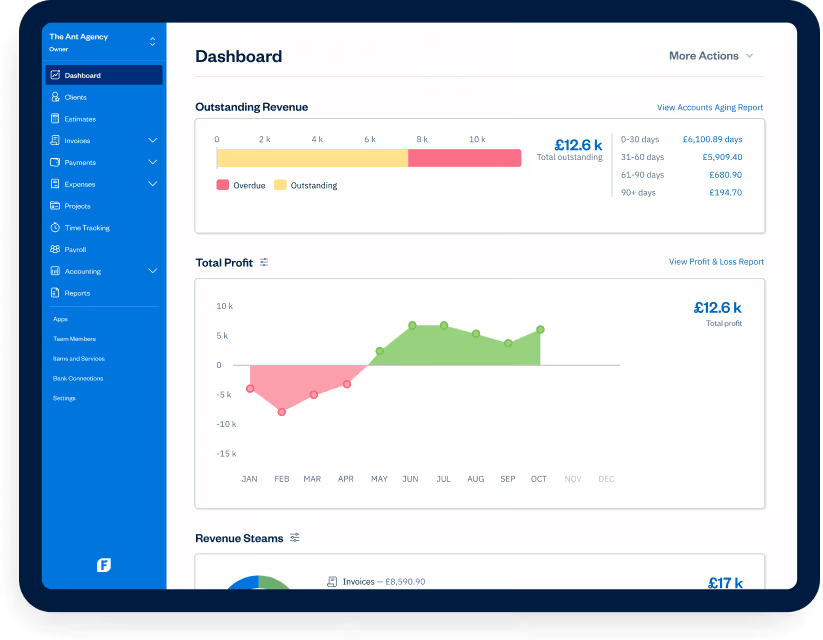

FreshBooks is best known for its simplicity and customer-friendly design. It’s an excellent QuickBooks alternative for freelancers, consultants, and small businesses that want streamlined billing and time tracking. While not a full ERP, it offers solid accounting tools, clear dashboards, and expense tracking features.

Key Features:

Pricing:

Plans start at $19/month, with advanced tiers up to $60/month.

Why It’s a Strong Alternative:

If your primary struggle with QuickBooks is invoicing and client billing complexity, FreshBooks delivers a cleaner experience without unnecessary accounting overhead.

Best for: Freelancers, consultants, and small service-based companies

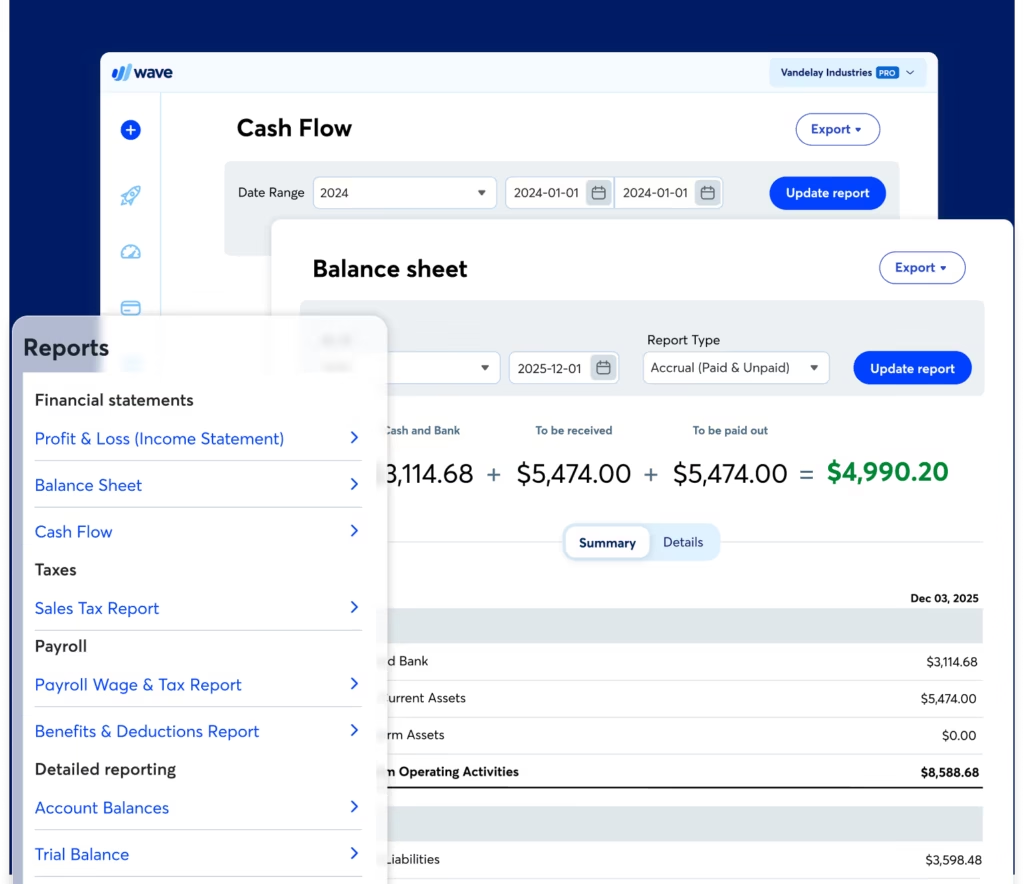

Wave is a free accounting platform that covers the basics — invoicing, accounting, and receipts. It’s designed for freelancers and microbusinesses who want a budget-friendly QuickBooks replacement without sacrificing essential features. While it doesn’t offer ERP-level automation, it’s simple enough for non-accountants to use effectively.

Key Features:

Pricing:

Core accounting tools are free, payment processing and payroll have transaction-based fees.

Why It’s a Strong Alternative:

For small startups that find QuickBooks expensive or overly complex, Wave offers an accessible starting point with clean usability and no subscription cost.

Best for: Solo entrepreneurs and small startups on a tight budget

Odoo is an open-source ERP that covers accounting, CRM, inventory, HR, and more. Its modular approach lets businesses start small and expand as needed — making it a flexible upgrade from QuickBooks. You can host it on-premise or in the cloud, and its community-driven model means extensive customization options.

Key Features:

Pricing:

Starts at $31/user/month plus app costs.

Why It’s a Strong Alternative:

Odoo appeals to growing businesses that want ERP-grade functionality but prefer the freedom to customize without vendor lock-in.

Best for: Businesses needing flexibility and open-source customization

Acumatica is a modern, cloud-first ERP built for scalability. It’s designed for growing companies that need advanced financials, inventory, project management, and CRM in one place. Acumatica stands out with its transparent, user-based pricing — you pay for what you use, not per user.

Key Features:

Pricing:

Usage-based pricing model; typically starts around $1,000/month.

Why It’s a Strong Alternative:

Acumatica bridges the gap between lightweight accounting tools and full-fledged ERPs like NetSuite, offering scalability and flexibility for growing firms.

Best for: Manufacturers, distributors, and construction firms

Business Central is Microsoft’s mid-market ERP that integrates seamlessly with the Microsoft 365 ecosystem. It’s a strong step up for companies already using Excel, Teams, or Outlook. The platform offers financials, operations, sales, and service management — all accessible in the cloud.

Key Features:

Pricing:

Essentials plan at $70/user/month, Premium at $100/user/month.

Why It’s a Strong Alternative:

If your team already uses Microsoft tools, Business Central offers a smooth transition from QuickBooks with deep automation and reporting.

Best for: Businesses already using Microsoft ecosystem tools

SAP Business One is tailored for small and mid-sized enterprises needing advanced financial control and operational visibility. It combines accounting with inventory, CRM, and analytics, making it suitable for distribution and manufacturing businesses transitioning from QuickBooks.

Key Features:

Pricing:

Typically starts around $1,500/user (one-time license) or $100/user/month (cloud).

Why It’s a Strong Alternative:

SAP Business One offers a depth of process automation and data visibility that QuickBooks can’t match, making it ideal for production-heavy firms.

Best for: Manufacturing and distribution companies

Oracle Fusion Cloud ERP is built for large or rapidly scaling businesses that need enterprise-grade automation and intelligence. It brings together finance, procurement, project management, and analytics in one integrated suite. Its AI-driven insights and predictive analysis make it a powerhouse for CFOs managing growth and global operations.

Key Features:

Pricing:

Custom enterprise pricing (generally higher tier).

Why It’s a Strong Alternative:

Fusion ERP is suited for fast-scaling companies with global operations, offering unmatched automation and scalability beyond QuickBooks’ reach.

Best for: Enterprises or rapidly scaling organizations

Switching from QuickBooks isn’t just about getting “more features” — it’s about solving the specific problems slowing your growth. The best system depends on how your business is evolving, not just how big it’s become.

Here’s how to approach the decision like a growing business would:

We’ve seen companies switch too late — when reporting becomes unreliable or departments start working in silos. The ideal time to move is when QuickBooks begins holding your operations back, not when it breaks entirely.

Outgrowing QuickBooks isn’t a setback, it’s a sign your business is scaling. The right ERP system should simplify complexity, unify your data, and give leaders real-time insights. Whether you choose NetSuite for its all-in-one scalability, Sage Intacct for financial control, or Odoo for flexibility, the key is finding a system that fits your growth stage and industry needs.

If you’re planning to move from QuickBooks to NetSuite and want expert help with a smooth, risk-free transition, our NetSuite Migration Service covers everything — from data migration and configuration to training and go-live support.