A Complete Guide to Planning and Budgeting with NetSuite

Jan 07, 2025

Financial analysis and budgeting are the vital elements of every organization, irrespective of the size and industry. Strategic financial planning is essential for revenue forecasts, expenses regulation, and the preparation for growth. This has a greater influence on total revenue and business viability. However, today’s world is highly unpredictable, unstable. Thus, organizations need the tools that are flexible enough to help make the correct prognosis and map out further financial development.

This is where tools like NetSuite Planning and Budgeting become useful. They simplify such tedious processes in finances so that the business decision can be made on the right data and ahead of time on the changes of the market. Most traditional FSM are not dynamic enough to meet the needs of expanding businesses and thus end up with a lot of errors. So, it becomes essential to take up an approach of planning and budgeting with an ERP system like NetSuite.

In this blog, we’ll explore NetSuite’s planning and budgeting module, providing you with a clearer understanding of its financial management capabilities.

NetSuite Planning & Budgeting is an extra module of NetSuite which is under the ERP financial management strap. Although NetSuite ERP is integrated with all the fundamental accounts payable systems, the general ledger, and online financial reporting, it can be enhanced relating to planning and budgetary control choices. It is usually offered to companies that require advanced solutions to these.

More specifically, this module enables companies to incorporate advanced FP elements, e.g., forecasting tools, scenario modeling, variance analysis into a business’s ERP system. This increases efficiency by eliminating key manual steps in financial management and by offering real-time tools to drive further efficiency in business planning and operations.

Let us discuss the key components of NetSuite Financial Planning and Budgeting as a useful tool in your business:

Scenario Planning in NetSuite helps finance teams anticipate financial outcomes by simulating various conditions and their impact on cash flow. This hierarchical planning process supports informed decision-making by allowing users to assess potential strategies and avoid unexpected setbacks. Common planning actions include adjusting headcount costs and evaluating Cost of Goods Sold (COGS) Planning.

NetSuite leverages AI-powered predictive analytics to enhance Intelligent Performance Management. This feature provides finance teams with insights through data-driven predictions, enabling more accurate budget trending and financial reports. By automating certain processes, AI helps reduce the burden of manual calculations and improves the reliability of sales forecasts.

Read More : A Complete NetSuite AI Features Guide with Use Cases

Revenue Planning in NetSuite aids in creating detailed sales plans and revenue forecasts. Using indirect cash flow methods, the platform evaluates different revenue streams to optimize financial outcomes. This feature helps organizations align their sales forecasts with corporate objectives, ensuring strategic alignment with operational goals.

Integration with Microsoft Office enhances collaboration with the finance team by allowing seamless data exchange and communication. Users can easily integrate their financial reports into Excel, facilitating data sharing across departments. This integration supports collaborative financial planning, ensuring that all stakeholders have access to accurate and up-to-date information.

NetSuite Planning & Budgeting solutions is a far cry from the conventional, time-consuming and largely static methods. This tool is much more precise, effective and capable of accommodating unprecedented growth and offers the following:

The platform’s ability to generate accurate revenue forecasts and sales plans leads to improved financial reporting and outcomes. Multidimensional planning allows finance teams to incorporate complex calculations, such as COGS Planning and headcount costs, ensuring precise forecasts. Pre-built synchronization and real-time data insights help maintain forecast accuracy, minimizing variances and unexpected financial surprises.

A spreadsheet of NetSuite Planning & Budgeting also eradicates several financial processes, greatly cutting down the planning cycle time. The constant use of jobs like data entry, report writing, and even data analysis implies that businesses will mean working less on spreadsheets, but more on data analysis.

NetSuite’s user-friendly interface and intelligent performance management expedite the implementation process, providing fast time to value. Built-in features and automated processes reduce the complexity of traditional financial planning, quickly delivering insights into financial statements and key features. This accelerated timeline allows businesses to swiftly adapt to market changes and optimize financial strategies.

The system provides integrated audit trails and validation capabilities, which imply Clear financial process. It helps also to keep track of any changes in the figures applied in the financials area and it is critical in terms of regulatory compliance and tracking within the organisation.

Multi Subsidiary and multinational companies will also benefit from NetSuite due to its ability to perform financial planning in different currencies owned by different subsidiaries. The system is capable of handling multi country operations and consolidation of financial records, which can assist in financial control to various areas.

“90% of NetSuite Planning and Budgeting customers surveyed have achieved increased visibility, control over their business operations, and more organizational alignment.”

Source: NetSuite.com

NetSuite Planning and Budgeting revolutionizes how finance teams approach the budgeting process. By integrating flexible driver-based planning and multidimensional planning, it enables organizations to make informed decisions quickly. This approach shifts the focus from static, inflexible models to dynamic, real-time forecasts that align closely with financial statements and outcomes.

Traditional spreadsheet methods often involve complex calculations and manual data entry, which increases the risk of errors. In contrast, NetSuite offers pre-built synchronization and automated data inputs, significantly reducing the likelihood of inaccuracies. This scalable solution allows for efficient financial reporting and preparation of balance sheets, cash flow statements, and other financial reports without the manual work.

With features like budget trending and Intelligent Performance Management, NetSuite streamlines budgeting and forecasting processes. It offers real-time capabilities for revenue forecasts, sales forecasts, and headcount costs, ensuring timely and accurate financial planning. Finance teams benefit from a hierarchical planning process that enables collaboration with corporate finance, optimizing sales plans alongside COGS planning.

Eliminating manual input is key to improving efficiency and accuracy. NetSuite facilitates this by automating the import of financial data and enabling common planning actions through intuitive interfaces. As a result, finance teams can focus more on analysis and strategy rather than data entry tasks, leading to better financial outcomes and insights into the impact on cash flow.

Data synchronization is vital for accurate financial reporting and decision-making. NetSuite uses pre-built synchronization to ensure that all financial data across departments is current and consistent. This fosters collaboration within finance teams, supports indirect cash flow methods, and enhances the overall accuracy of complex calculations. Through synchronized data, organizations can better forecast and align their financial strategies.

NetSuite Planning and Budgeting is a scalable solution that caters to a variety of industries by addressing their unique financial planning needs. With its flexible driver-based planning and multidimensional planning capabilities, it suits diverse corporate finance requirements.

NetSuite Planning and Budgeting is a scalable solution that caters to a variety of industries by addressing their unique financial planning needs.

Industries such as technology, manufacturing, retail, and healthcare benefit greatly from NetSuite Planning and Budgeting. The platform supports complex calculations for COGS planning and indirect cash flow methods, making it ideal for intricate financial reporting. Moreover, its impact on cash flow management and the ability to produce real-time forecasts ensure that finance teams in these sectors can make informed decisions.

Software companies utilize NetSuite Planning and Budgeting for detailed workforce planning and sales forecasts. By facilitating collaboration with finance teams, it helps in aligning sales plans with budget trending and financial outcomes. The hierarchical planning process aids in mapping headcount costs and providing real-time revenue forecasts, ensuring business growth is well-managed.

| Feature | Benefit |

|---|---|

| Flexible driver-based planning | Adapts to various financial models |

| Workforce planning | Optimizes human resource allocation |

| Real-time forecasts | Enhances decision-making speed |

| Customizable editions | Aligns with unique business strategies |

By offering a suite of powerful features, NetSuite Planning and Budgeting ensures seamless financial operations across a range of industries.

NetSuite offers customizable editions tailored to specific business needs, allowing for intelligent performance management and pre-built synchronization with existing systems. Companies can opt for editions that meet their requirements in areas such as monthly balance sheets, cash flow statements, and financial reports. This customization ensures that all companies, regardless of size or sector, can efficiently plan and forecast their financial future.

The cost of NetSuite Planning & Budgeting is based on the selected edition, the level of customization required, customer type or size. Standard NetSuite pricing are most commonly one-year licenses with the cost based on the number of user licenses and features in the package. Some other features and/or consulting services may increase the price.

NetSuite has different options to its Planning & Budgeting module including:

NetSuite solutions for finance businesses are ideal for companies aiming to streamline financial outcomes through budget trending and monitoring the impact on cash flow. Collaborations with finance become seamless thanks to pre-built synchronization, fostering a cohesive corporate finance strategy. These solutions also assist in workforce planning by aligning headcount costs with sales plans and adapting revenue forecasts with agility.

Consider the following key features:

| Feature | Benefit |

|---|

| Flexible driver-based planning | Adapts to market changes effortlessly |

| COGS and Indirect Cash Flow Analysis | Enhances understanding of cash movements |

| Intelligent Performance Management | Boosts strategic decision-making |

If your business values comprehensive financial statements incorporating elements like balance sheets and cash flow statements while allowing for the integration of common planning actions, then NetSuite could be the right fit for enabling a robust financial ecosystem.

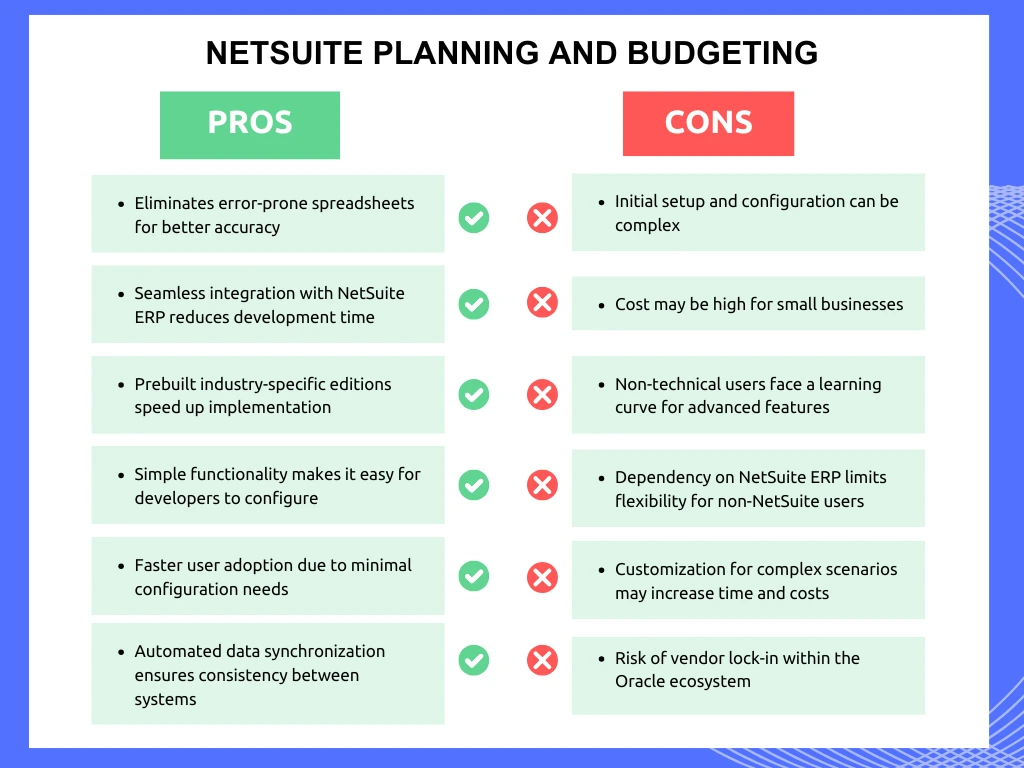

NetSuite Planning & Budgeting is an essential tool for businesses looking to enhance their financial management capabilities. Whether you are a small business in need of basic forecasting or a large enterprise requiring advanced scenario modeling, this module offers a comprehensive, scalable solution. With its ability to integrate seamlessly with NetSuite ERP and its array of customizable features, businesses can ensure their financial planning processes are efficient, transparent, and data-driven.